In late 2021, Sid joined ChartMogul, a subscription analytics platform:

“At ChartMogul, we bring in your billing data from payment providers or billing systems like Stripe, Recurly, and Chargebee. We then massage that data to make it clean and give you clean metrics such as ARR, churn rate, retention rate, and others.

Because we see a lot of startups using our platform, my job is to anonymize, aggregate, and get the trends out of the data. For example, we can answer questions like, ‘what’s a good churn rate?’ or ‘what’s a good retention rate?’ and just share it with the industry.”

Prior to joining ChartMogul, Sid worked at J.P. Morgan for seven years. And while finance and tech are two very different industries, he shares that there are still similarities between them:

“It’s the same and different energy in some ways. It’s similar in the way that everyone is building a business and they want to generate profit. The difference is I find my work a lot more purposeful because of the problems we’re solving. Working on very concrete customer problems, being close to the customers, and being a part of that journey with them makes me feel like I’m able to deliver more in terms of work and I have more of an impact.”

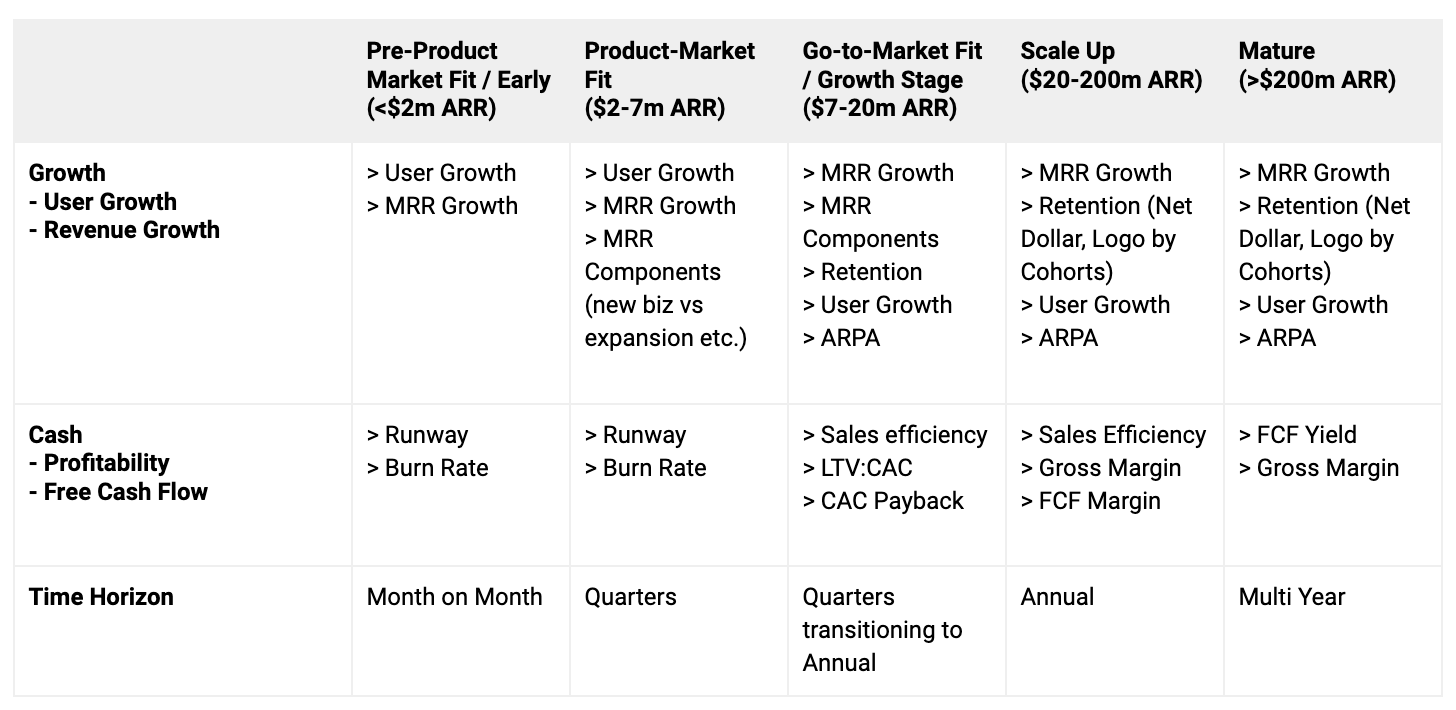

The stages of the company lifecycle and the key metrics you should care about at each stage

Stage 1: Pre-product market fit

“Pre-product market fit companies have this idea and start working on it but they’re yet to go through the journey to achieve product market fit. They’re still talking to customers to figure out the problem that they’re going to solve.”

Stage 2: Product-market fit

“The second stage is when you’ve achieved product-market fit and you have a strong customer base who uses your product and are ready to pay you.”

Stage 3: Go-to-market (growth stage)

“Once you have achieved product-market fit, you know there are customers out there who want to use your product and they want to pay for it, but that doesn’t mean you can acquire these sorts of customers in a repeatable and profitable fashion.

At this stage, you’re trying to figure out your marketing strategies or your go-to-market motion. You’re also thinking about your customer acquisition cost and whether your marketing and sales functions can scale with the product and the rest of the organization.”

Stage 4: Scale up

“Now that you have product-market fit and know how to acquire customers profitably, all you want to do is just do this repeatedly so that you’re able to grow at a fast pace.”

Stage 5: Mature

“The final stage is you go into a mature phase of the business, meaning you’ve scaled up all aspects of the business. You’re a mature business that’s growing fast and is profitable.

Some examples of mature phase businesses are Salesforce, Adobe, ServiceNow, or Atlassian. These are businesses that have been in existence for more than 15 years and have hundreds of millions in ARR.”

And as your business goes through these growth stages, the key metrics also change.

Sid advises to use this table as a guide and adapt what works for your company:

“Not every stage will be relevant for each company. For example, there are companies that would mature at $15 million ARR because they don’t have a very big total addressable market.”

Key categories of metrics

Regardless of what stage your business is in, most metrics fall into two overarching categories.

Growth metrics

“How fast is your user base growing? How fast is your revenue growing?”

Cash or profitability metrics

“What’s your cash runway? What’s your burn rate? What’s your free cash flow margin?”

High frequency vs. low frequency metrics

High frequency metrics have values that change from month to month and serve as indicators of where your business is headed:

“Something like monthly churn and new user signups are high frequency metrics that change monthly.”

Sid advises that it’s best to optimize for some of your high frequency metrics as you’re building out your business.

Low frequency metrics on the other hand, don’t change that much:

“For example, if you look at something like retention, what percentage of your users that you acquired a year ago are still staying with you? That’s something that’s a bit of a lagging indicator and will not change as much from month to month. Other metrics like your total user base or total number of users on the platform are lower frequency metrics or wouldn’t change as much compared to the number of new users signed up.”

The evolution of tracking metrics throughout the company life cycle

For SaaS businesses in the early stages, the most important growth metrics to track is user growth:

“You want to be on top of user growth because at the start of the business, that’s the only thing that matters. Do you have traction with your users? That’s the first metric that I encourage everyone to track.”

And you’ll also want to look at churn:

“Churn gets a lot of bad press in the industry because it’s complex to calculate and it’s a very heavy metric, but I kind of really like it for early-stage businesses because it’s a very high frequency metric.

During these early stages, you are focused on month-on-month or quarter-on-quarter metrics and churn does the job. It shows you what percentage of your users are sticking around every month or what percentage of business is churning.”

And as you’re trying to find your product-market fit, you should start tracking revenue as well:

“What’s your MRR or ARR that’s coming from these users? Are you able to monetize some of these users and are they generating revenue? This is the second thing that you should try to track as you grow from pre-product market fit to product-market fit.”

During the go-to-market stage, you should now track where your MRR is coming from:

“Is it coming from new business or is it coming from expansion? Just having a strong handle on how MRR is flowing into and out of your business is really important.”

Healthy growth rate for startups

A healthy growth rate for startups varies dramatically because you first have to figure out what sort of business you want to build:

“Do you want to build a venture-scale, multi-billion ARR business? Or are you perfectly happy with building a 50 million ARR business that’s profitable and growing steadily?”

In the 100K to 100M ARR band, it’s very normal to grow 100% per year:

“For example, you’re a 1M ARR business and you grow to 2 million in one year. That’s the growth rate that we’re looking at in very early-stage businesses. But as you continue to grow, that growth rate clearly drops to maybe 60% or 70%. And this is not exactly the venture-scale type of business.”

Venture capitalists like to invest in T3D2 businesses where companies triple their revenue every year in the first three years, and double it every year in the next two years:

“Companies like Slack have gone through this journey and have delivered this kind of returns.”

But unlike Slack that has struck a complete and immediate product-market fit, the T3D2 framework is unrealistic for most startups:

“It’s completely unrealistic. These are the 95th to 99th percentile of startups or companies.”

For a funded startup, going from zero to 1M ARR in a year and half or two is considered healthy. For bootstrapped startups, 30% to 40% growth is the healthy growth rate.

Using segmentation and cohorts

Every metric that you measure should also be measured in a cohort-based fashion because it helps keep things consistent. A cohort is just a complex name for a group of customers.

For example, for businesses in the scale up or mature phase, a metric that should be measured in a cohort-based fashion is net retention because it tells you if you’re able to acquire and retain customers:

“Take a cohort of customers who were there with you one year ago and look at how much MRR they generated for your business. Let’s say that they generated around 10 million in ARR. From that cohort, calculate how many customers were retained one year after. What percentage of MRR or ARR will you be able to retain?”

Let’s say some customers (2 million ARR) would churn. But on the other hand, you were also able to upsell your other existing customers or you might have usage-based pricing in place, bringing the 8 million ARR to 12 million ARR.

“You go from like 10 million a year ago to like 12 million today. You have a really good cohort-based net retention. It’s really important to get a sense of this cohort-based system of doing things because that helps you keep things consistent.”

Another thing you can do with cohorts is to look at them on a monthly or quarterly basis:

“Over time, how is every cohort evolving? How is the cohort from quarter one of last year compared to quarter two of last year, to quarter three of last year, and to this year? Have that time series and see whether your metrics are trending in the right direction.”

How growth metrics change across the company life cycle

“At the initial stages of the life cycle, user growth is the most important metric. But as you scale up and mature, people are looking at turning that user growth into revenue growth. Let’s say you’re able to get users to use your platform, but that’s not enough. You want people to pay for your product and generate revenue.”

Which is why at the scale up and mature phases, metrics like MRR growth rate and ARR growth rate become the two most important metrics.

Companies also look at average revenue per account (ARPA) or the average contract value as they grow:

“You want to see that trend up because it means customers are using your product more and more. They stick with you and increase what they pay you yearly.”

Retention is also another metric that companies track as they mature because it closely relates to high growth:

“If you’re acquiring customers, are they able to stay with you over a long duration of time? And that’s important. You can look at this in terms of either net dollar retention or as customer retention.”

How cash metrics change across the company life cycle

Aside from revenue growth, businesses should also look at cash and profitability when going through the life cycle. During the pre-product market fit to product-market fit stages, it’s about cash runway or burn rate:

“How many months of runway do you have? What kind of growth metrics do you want to show to get that next round of funding? So you are worried about the cash in the bank and whether you have a business at all.”

During the growth stage, you start to care about metrics like the LTV, LTV to CAC ratio, and CAC payback period:

“Now that you have customers and like you have achieved product-market fit, how profitably can you acquire these customers? Are there favorable or profitable unit economics in your business? These are the kinds of things that you want to optimize for in the later stages of the business.”

And as a company grows to the scale-up and mature stages, other metrics like free cash flow margin, free cash flow yield, and gross margin become important.

Blitz question round

Q: In terms of marketing metrics, what should startups be worried about?

A: Website visits, number of leads, MQLs, SQLs, and eventually conversions.

“As you grow from go-to-market to the scale-up stage, it’s all about the conversion.”

Q: Do NPS scores really reflect reality?

A: You should care about NPS but not as much as you care about revenue or churn.

“You always want to be in touch with your customers and you can do those NPS surveys and look at customer engagement scores, but at the end of the day, customers vote with their dollars.

If they’re not happy, they’ll cancel the subscription. Your NPS score could be low and if they continue to pay, it tells you that they may be unhappy with your product, but it’s still solving something for them and it’s an important product to them.”

Q: What metric should you be tracking in the sales department?

A: Quota attainment ratios, quota given per sales rep, percentage of goal/plan versus actual achievement

“You’re looking at things like quota attainment ratios compared to the quota that’s been given to every sales rep. What percentage of that were they able to achieve and plan versus what they’ve actually achieved. Another thing would be how much quota did you give every rep and does it increase every year?”

Q: How do you measure customer success efforts?

A: Retention and customer satisfaction score (CSAT).

“Customer success efforts are measured by retention. The key metric that customer success optimizes for is net dollar retention, customer retention, or gross dollar retention. They also look at customer metrics like the CSAT.”

Q: What do mature companies care about when they’re at their ultimate stage?

A: Cash profitability and growth.

“So companies like Adobe or Salesforce really care about their ability to generate cash for their investors or for the company. They’re able to grow profitably year on year so at the ultimate level, what matters is just things like free cash flow yield.

The second thing that they’re optimizing for is growth. What I’d like to highlight here is you could have a really high growth rate, but at the mature stage of the business, if you’re not doing it profitably, it doesn’t matter because investors wouldn’t care about you. What matters is having a good balance between growth and cash profitability.”

Q: What’s the difference between B2B and B2C?

A: Retention and churn rates.

“In terms of B2B and B2C startups, you see that B2B retention tends to be much higher and churn tends to be much lower. These types of businesses go through a sales cycle and they stay along for a longer duration of time. Whereas in B2C, you have a lot more customer churn. In terms of marketing, it tends to be very different in B2C versus B2B.

In B2C, you need to have some sort of low cost acquisition strategies so things like virality that could help you grow really fast.”

Q: What are investment firms looking for in startups?

A: Early stage: high growth and T3D2. Mature and scale-up stage: growth, profitability, and cash flow related metrics.

“In early stage startups, most investors are venture capital-based investors, and what they’re looking for is really high growth and things like T3D2. On the other side of the spectrum, the mature and scale-up businesses, they’re definitely focused on growth, but they’re also hyperfocused on profitability and cash flow related metrics.”

Final advice

Do start building a data-driven culture from the start.

“There’s no perfect data or perfect way to measure things. Start measuring your metrics from the very start and it’ll evolve over time.”

Don’t overcomplicate things.

“Simplify your metrics and optimize for two or three metrics that you really care about.”

Thanks for listening! If you found the episode useful, please spread the word on Twitter mentioning @userlist, or leave us a review on iTunes.