This article describes a positioning exercise we did in 2019. Huge thanks to April Dunford for her amazing positioning method. The framework/template/canvas can be applied to your business today.

We started Userlist in 2017 as an alternative to bulky enterprise messaging tools, but until lately, we’ve been having a hard time explaining what exactly the product does. Our elevator pitch clearly didn’t work…

Thankfully, a couple months ago, Claire came back from LTV Conference in New York, enlightened and inspired by April Dunford’s talk on positioning. Then we got our hands on April’s new book, Obviously Awesome, and applied her 10-step positioning method to solve our problem.

A change in positioning from “email automation” to “customer messaging,” as well as calling out our primary competitors (especially Intercom) by name, had a magic effect. Now potential customers instantly grasp what we do, and clearly appreciate the value of our tool. It was a thrill.

So we’re sharing it with you — maybe it will be helpful for your business as well.

Below you’ll find the exact steps from April’s book as we worked through them. Excerpts from the book (instructions for each step) are in italics, followed by our answers.

Update. Nothing is set in stone, and we have been tweaking our positioning as we go. Here's how it has changed over the years:

- 2017-2018: "email automation for SaaS" — our original take.

- 2019-2021: "customer messaging for SaaS" — as described in this article.

- 2021-2022: "email automation for SaaS" — as we added marketing email alongside customer lifecycle email. Funny how it circles back to our original positioning.

- From March to October 2022: "company-level email automation for SaaS" — same idea, but focusing on our unique value proposition which is the company accounts.

- 2022 and onwards: "email marketing platform for B2B SaaS." We still offer company-level features, but it was too confusing for many people as part of the value proposition. So we're back to a classic ESP for B2B SaaS.

Now, let's dive into April Dunford's method.

How we applied April Dunford's positioning method, step-by-step

Step 1. Understand the Customers Who Love Your Product

“The first step in the positioning exercise is to make a short list of your best customers. They understood your product quickly and bought from you quickly. They became raving fans, referred you to other companies and acted as a reference for you. They represent the perfect type of customer you want to buy from you (at least in the short term).”

We prepared for that question well and even put together a dedicated page on our website featuring some of these customers. We won’t call out the names here, but most raving fans have been fellow SaaS founders who were fairly technical (hence didn’t have any problems with the integration). We also had a few marketers at larger companies who were also enthusiastic about our solution.

Sidenote. We spent the last 6 months doing an enormous amount of demo calls, and this was very helpful for this workshop. We had gathered insights from real people — some of them became our customers and some of them didn’t — and were well aware of common problems and sentiments. If you’re just starting out, it’s worth investing your time into customer calls first, so that you have legitimate material for your positioning exercise.

Step 2. Form a Positioning Team

“Positioning is intertwined with the overall business strategy and therefore needs to be led by the business leader. Because positioning impacts the overall team in significant ways, the leaders of each business function must also agree with and execute the positioning, so they should be involved in developing it.”

This one was easy: we’re a team of three representing all business “departments”, so we did it together. As a product leader, I prepared the materials upfront, and then we had a guided discussion together. We didn’t bring in an external facilitator (which April highly recommends), but tried to achieve a similar level of discipline and objectivity.

Step 3. Align Your Positioning Vocabulary and Let Go of Your Positioning Baggage

All three of us came prepared, armed with information from the book:

- What positioning means and why it is important

- Which components make up a position and how we define each of those

- How market maturity and competitive landscape impact the style of positioning you choose for a product

We also did our best to let go of our “positioning baggage.” We came intentionally open-minded and ready to challenge our previous assumptions about Userlist and its audience (which is never easy as you get buried in your own product).

April says: “If we have always thought of our product in one way — as competing in a particular market, or solving a particular problem — it’s hard to see it in any other way. The reality is that most products can be many things to many types of buyers.”

Step 4. List Your True Competitive Alternatives

“What would our best customers do if we didn’t exist? The answer could be that they would use another product that looks like a direct competitor with you. But often that’s not the case. For many new products, the answer is “use a pen and paper” or “hire an intern to do it.” Some of the startups I work with have ideas so innovative that customers don’t even understand that they have a problem — if the product didn’t exist, they would simply “do nothing.”

The following insight was eye-opening, as well as relieving:

“Don’t forget that you are an expert in solutions in this space and quite likely understand the real competitive landscape much better than customers do.”

April also recommends to cluster these alternatives into groups. We analyzed our interview data and ended up with four groups. What would our users do if they didn’t have Userlist on hand to send out behavior-based messages to their SaaS customers?

- Follow up with new customers manually

- Build an in-house solution

- Use a general-purpose email automation tool like Drip or ConvertKit

- User a dedicated messaging tool like Intercom or Customer.io

Step 5. Isolate Your Unique Attributes or Features

“Once you have a list of competitive alternatives, the next step is to isolate what makes you different and better than those alternatives. In this step you need to stay focused on features and capabilities (also called attributes), rather than the value that those features drive for customers.”

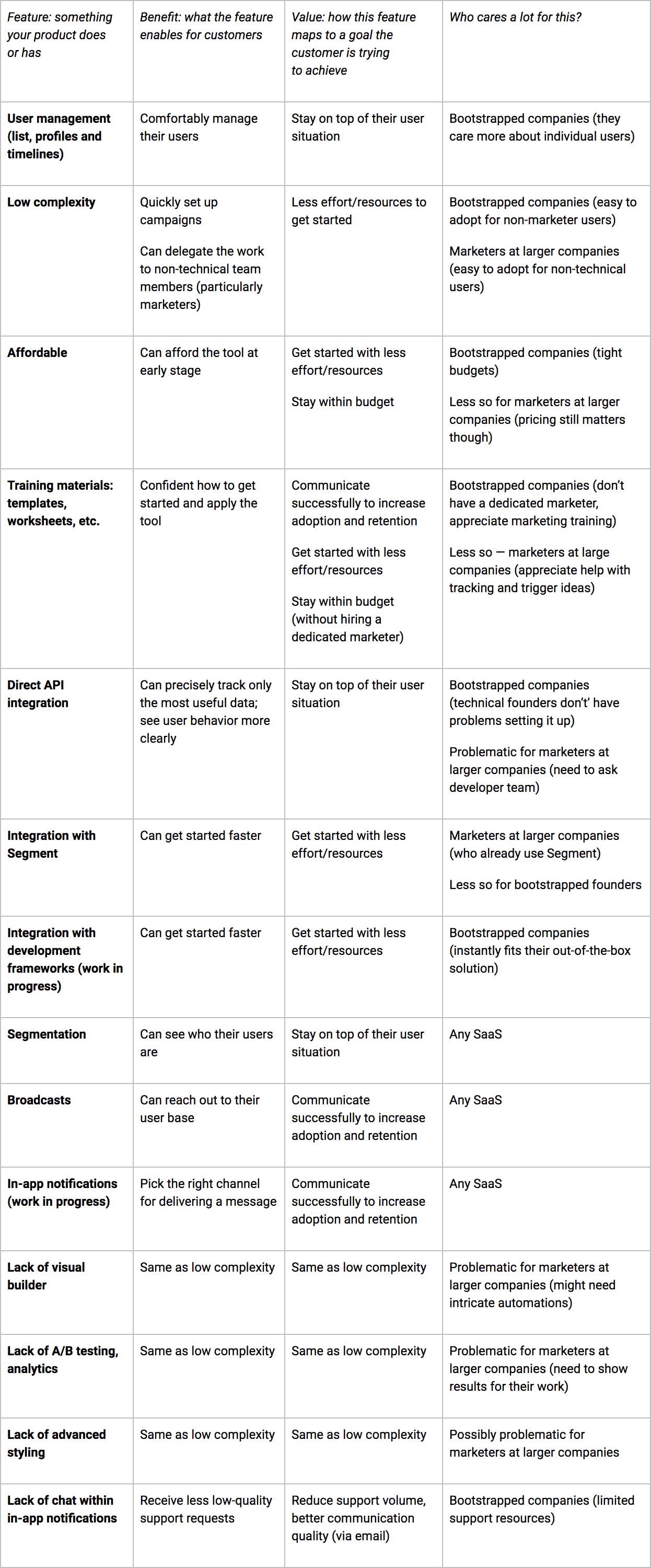

See table below for our answers to steps 5, 6 & 7.

We started out with only a few differentiating features, but ended up in a complete mindstorm. We wrote down all existing features, and even those that are missing (either as a strategic decision, or because we haven’t built them yet).

Sidenote. From the marketing standpoint, “simple” and “affordable” are poor selling points. You don’t want to communicate the message of being cheap or scrappy. However, Userlist is precisely simple and affordable if you compare it to tools like Intercom. So we rephrased “simple” into “less complex.”

Step 6. Map the Attributes to Value “Themes”

“In this step, you’ll capture the value that each of your unique attributes enables for customers. Group attributes that provide similar value so you can get down to a more reasonable number.”

Here’s the table that we put together to address this question.

We ended up with three value clusters, phrasing them as action verbs (it’s a good UX habit to name things as actions that users can do):

- Get started with less effort/resources

- Stay on top of their user situation (user management)

- Communicate successfully to increase adoption and retention (improving KPIs)

Sidenote. After completing the table, we gained an important insight about our product. “Getting started” is generating core value for the customer. “Getting started” isn’t merely adoption! It’s the core use of product itself. Also, it’s enormously painful for all groups of users (independent of the tool). A large part of users would set up their automated campaigns, put messaging on autopilot, and rarely log into Userlist on daily basis.

Benedikt shared a sentiment that pricing and setup efforts correlate. Higher price of Customer.io and Intercom might be related to the ability of their customers to efficiently integrate the tool. More money to spend means (more often than not) a bigger team, which makes it easier to dedicate employee time to building the integration and writing the campaigns.

Step 7. Determine Who Cares a Lot

“Once you have a good understanding of the value that your product delivers versus other alternatives, you can look at which customers really care a lot about that value.”

We added another column to the table above, and brainstormed who would appreciate each of our individual features (and which of them can be problematic). We addressed two primary audience groups — code-named as “bootstrapped companies” and “marketers at larger companies.”

The takeaway was very obvious: most of our features are valuable for smaller companies, while marketers at larger companies would see some of them as problematic. Let’s take our lack of analytics or A/B testing as an example — marketing professionals would need these features to demonstrate the results of their work. We’re a much better fit for people who “just need it done” than for those who need to continuously optimize things.

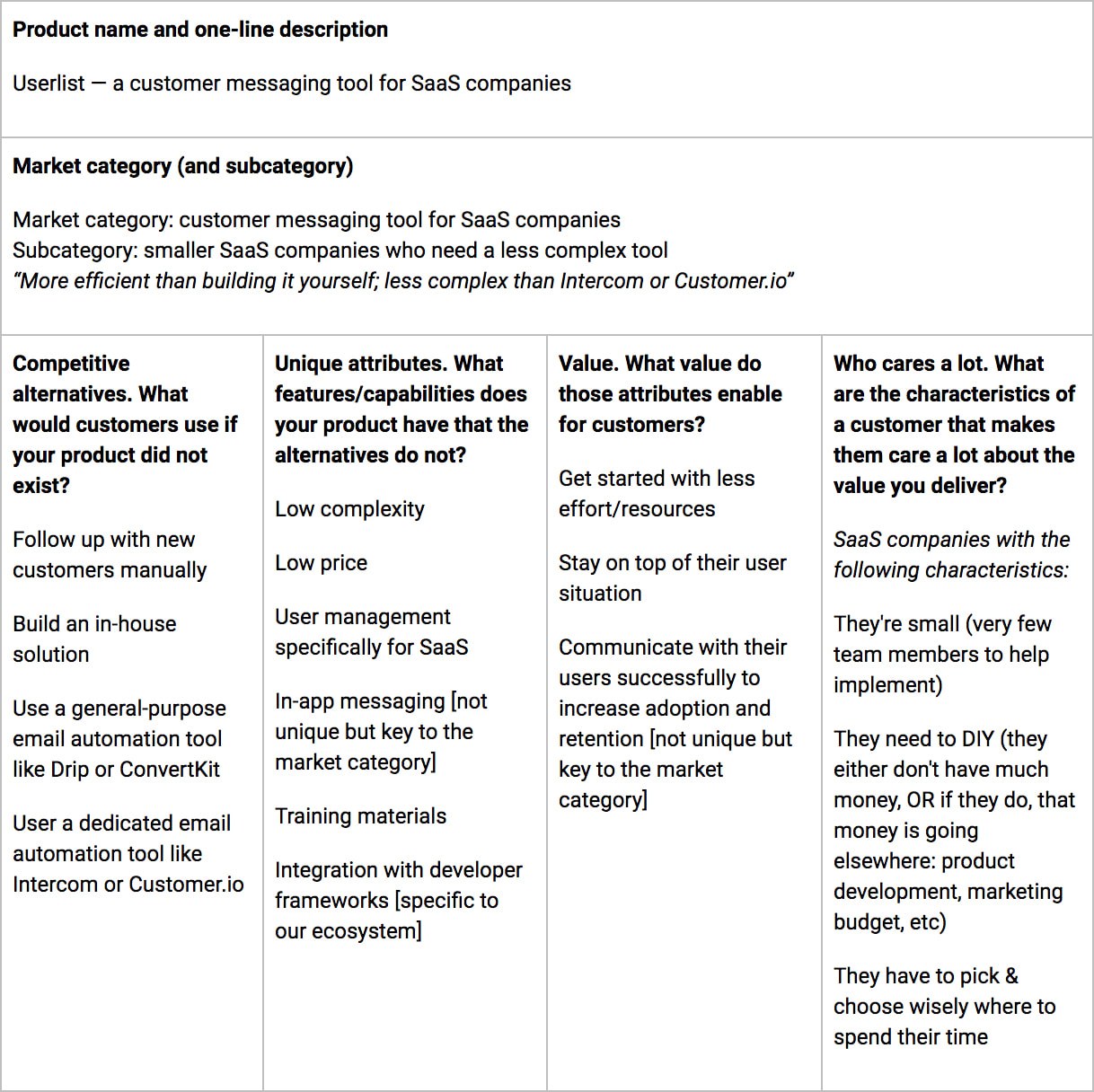

We decided to use characteristics (instead of roles) to describe such companies:

- They’re small (very few team members to help implement)

- They need to DIY (they either don’t have much money, OR if they do, that money is going elsewhere: product development, marketing budget, etc)

- They have to pick & choose wisely where to spend their time

Step 8. Find a Market Frame of Reference that Puts Your Strengths at the Center and Determine How to Position in It

April outlines three possible positioning strategies in her book:

- Head to Head: Positioning to win an existing market.

- Big Fish, Small Pond: Positioning to win a subsegment of an existing market.

- Create a New Game: Positioning to win a market you create.

Our answer is clearly the “big fish, small pond” strategy for Userlist, with the general existing market dominated by Intercom. This general market category is “customer messaging tools” — that’s how Intercom calls themselves, and it’s easy for people to understand.

Previously, our market category was “email automation tools” which clearly didn’t work. People started comparing us with Drip, ConvertKit, ActiveCampaign, etc. — and we struggled to explain why we’re better. Email automation tools have way more advanced features that we’re not planning to implement soon (rich visual templates, A/B testing, visual workflow builders, analytics). While “customer messaging tools” don’t require these features, and align fantastically with our plan to introduce in-app notifications.

Our “small pond” would be a subcategory of SaaS companies who need a focused, less complex messaging tool (see step 7 for their characteristics).

We decided to stay “open” about this sub-category and fine-tune it later, as we grow and learn more from our paying customers. For younger companies, April says, it’s okay “to cast a wider net” and then refine positioning later.

Sidenote. April shared one particularly relevant story — how a struggling CRM product (“cheaper, crappier Siebel”) repositioned to “a CRM for investment banks” and achieved fantastic results. They chose that niche based on a single unique feature that fascinated investment banks, even though the product underperformed on other general features.

This made us think… What if we could do the same and niche even deeper? But we didn’t come up with a particular differentiator (yet). However we’ll keep this idea in mind in case an opportunity emerges.

Calling out competitors by name. Previously we were also afraid to call out competitors by name. Intercom was “the elephant in the room” but saying it out loud didn’t feel right. April’s book taught us that this can be a highly effective thing to do; and we also received similar advice from other people.

Josh Garofalo pointed us to the work he did for Tom’s Planner:

“They are a Gantt chart/project planning tool. Their audience needed something more sophisticated than spreadsheets but less intimidating than MS Project. These tools were mentioned over and over again. So I didn’t beat around the bush. I called out those products as ok for certain people, but positioned Tom’s Planner in the middle of the two. Signups are way up and they’re converting quickly because they see themselves in this positioning strategy.”

Marc Köhlbrugge of BetaList recommended the same:

“Have you considered calling out Intercom by name? We all know that’s your biggest competitor, and you’re clearly differentiating from them on their two main drawbacks: complexity and pricing. IMO it’s worth being a bit more brazen in telling why Userlist is the better choice.”

We followed their advice and called out both of our primary competitors (DIY and Intercom/Customer.io) in the following positioning statement: “More efficient than building it yourself; less complex than Intercom or Customer.io.”

Step 9. Layer On a Trend (but Be Careful)

“Once you have determined your market context, you can start to think about how you can layer a trend on top of your positioning to help potential customers understand why your offering is important to them right now. This step is optional but potentially really powerful — if you go about it carefully. A trend helps customers see your product as an urgent or strategic (or dare we say it, cool) purchase.”

We agreed that we can probably employ the “user onboarding” trend to make Userlist a more attractive purchase. Adoption is something that many SaaS business care a lot, and it’s also a popular topic in the community. Not like we’re putting “user onboarding” as the key value proposition — but we can effectively use this trend to produce relevant content and sales materials.

Step 10. Capture Your Positioning so It Can Be Shared (Positioning Canvas)

April says: “I’m a fan of having a shorter, concise version of the positioning that can be captured on a single page and easily shared across the company.”

Below you’ll find April’s positioning canvas filled out with our new Userlist strategy.

How to apply the positioning canvas in your marketing

So we completed the exercise and agreed on this new positioning strategy…

Now what?

First of all, we updated our website homepage with the new product description:

Send the Right Message at the Right Time. Onboard and engage your users with Userlist — a customer messaging tool for SaaS companies. More efficient than building it yourself; less complex than Intercom or Customer.io.

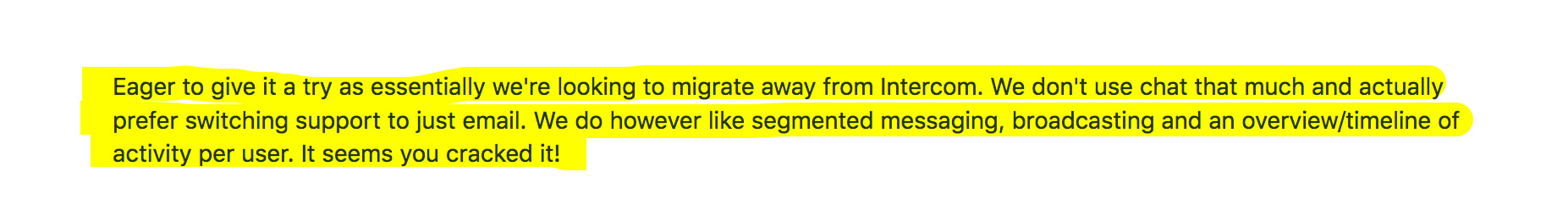

We didn’t change the product at all, but it instantly became a more attractive thing in the minds of our potential customers. That’s the magic of positioning. A few days later we successfully launched on BetaList, and received multiple raving comments (which of course made our heart melt):

But more importantly, we’ll be using this positioning canvas in future:

- To inform product decisions: what to build, and more importantly, what not to build.

- To inform content marketing: how to plan materials, and what topics to write about.

- To inform sales: how to pitch our product and the value it provides.

We can’t recommend this actionable 10-step method enough for any SaaS company, especially if you’re still in search for the perfect positioning. April’s book is waiting for you on Amazon.

Update. Here's what April says about this article…

Onwards to the new positioning horizons 🚀

— Regards, Jane.